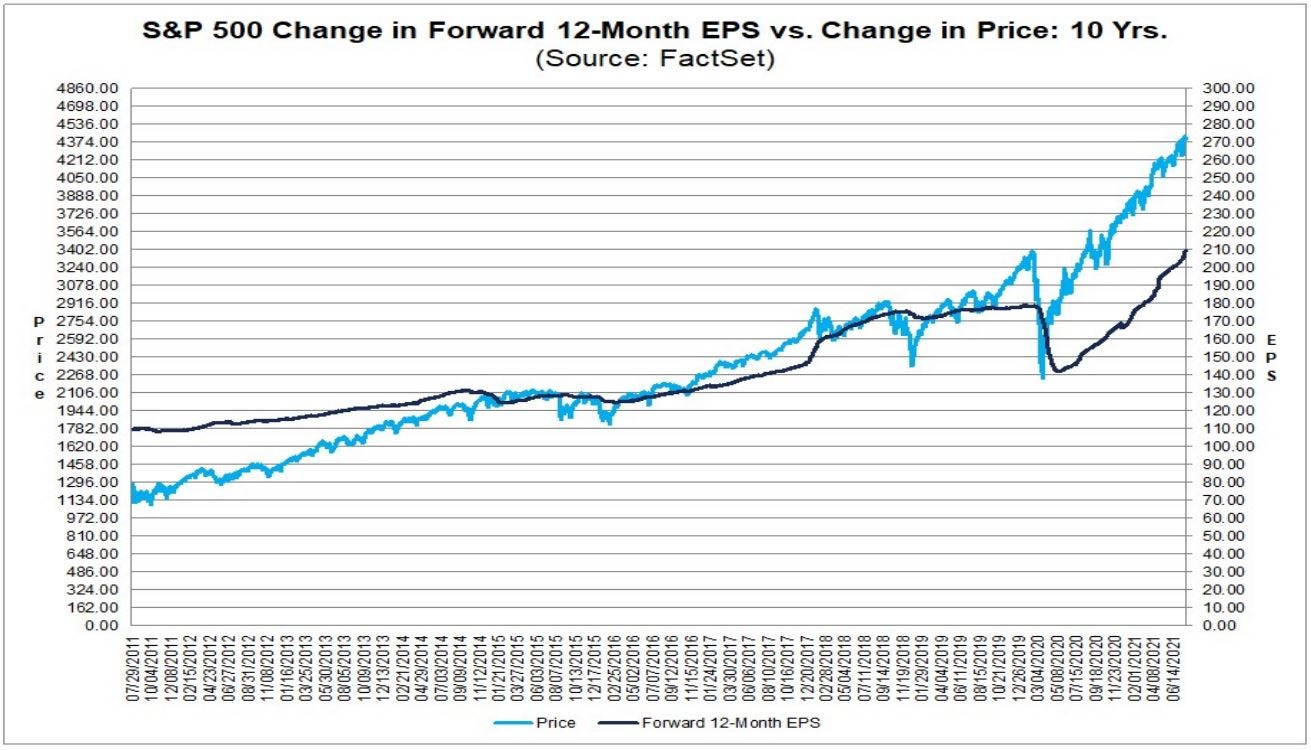

- Profit growth – which has historically been the biggest driver of stock-market returns – is seeing its fastest rise since 2009.

- The blended earnings growth rate for the second quarter stands at 85%, according to FactSet.

- Earnings results are surpassing analyst estimates, with 88% of companies reporting positive earnings and revenue beats.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Corporate earnings growth, which has historically been the main driver of stock market returns, is growing at its fastest pace since 2009, according to data compiled by FactSet.

With more than half of the S&P 500 having already reported second quarter earnings, year-over-year profit growth stands at 85%, well ahead of analyst estimates for earnings growth of 63%. And of the companies that have reported earnings so far, 88% have beaten both revenue and profit estimates.

The above-average earnings growth rates are due to both higher earnings for 2021 and an easier comparison relative to weaker earnings in 2020 due to the COVID-19 pandemic. In the fourth quarter of 2009, S&P 500 earnings grew 109%.

The strong earnings results have led Wall Street analysts to revise higher their earnings estimates for the third quarter, though at a slower pace relative to the past quarter, according to FactSet analyst John Butters. The Q3 bottom-up S&P 500 EPS estimate increased by 3.6% to $49.22 from $47.50 in the month of July, according to Butters.

"The third quarter marked the fifth straight quarter in which the bottom-up EPS estimate increased during the first month of the quarter, which is the longest streak since FactSet began tracking this metric in 2002," Butters said.

Sectors driving the increase in earnings estimates include Energy and Materials, while the Consumer Staples sector recorded a decline in analyst estimates for next quarter.

Companies driving large earnings beats this quarter included Alphabet, Apple, and Microsoft, while Amazon reported a mixed quarter that led to a 7% decline in its stock price on Friday.

Looking forward, 19 S&P 500 companies have issued negative earnings guidance for the third quarter, while 29 companies have issued positive earnings guidance.

The S&P 500 currently trades at a 12-month forward price-to-earnings ratio of 21.2x, which is lower than its recent reading of about 22x, but higher than its five an ten-year average of 18.1x and 16.2x, respectively, according to FactSet.